You are here:Chùa Bình Long – Phan Thiết > price

Bitcoin Price Chart with Moving Averages: A Comprehensive Analysis

Chùa Bình Long – Phan Thiết2024-09-21 03:30:03【price】1people have watched

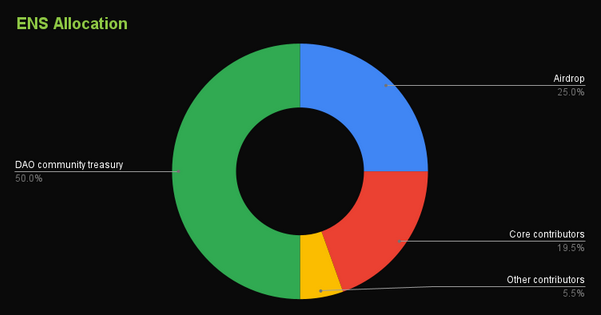

Introductioncrypto,coin,price,block,usd,today trading view,The world of cryptocurrencies has been evolving rapidly over the years, and Bitcoin, as the pioneer airdrop,dex,cex,markets,trade value chart,buy,The world of cryptocurrencies has been evolving rapidly over the years, and Bitcoin, as the pioneer

The world of cryptocurrencies has been evolving rapidly over the years, and Bitcoin, as the pioneer of this digital revolution, has always been at the forefront. One of the most crucial aspects of analyzing Bitcoin's performance is by examining its price chart with moving averages. In this article, we will delve into the significance of moving averages and how they can help us gain insights into Bitcoin's price trends.

Firstly, let's understand what moving averages are. Moving averages are a type of trend-following indicator that helps traders and investors identify the direction of the market. They are calculated by taking the average price of a security over a specified period and plotting it on a chart. There are various types of moving averages, such as simple moving averages (SMA) and exponential moving averages (EMA), each with its own unique characteristics.

The Bitcoin price chart with moving averages provides a visual representation of the cryptocurrency's price trends over time. By overlaying moving averages on the chart, we can observe how Bitcoin's price behaves relative to these averages. This analysis can help us make informed decisions about buying, selling, or holding Bitcoin.

One of the primary benefits of using moving averages in Bitcoin analysis is that they help smooth out price volatility. As we all know, Bitcoin's price can be highly volatile, making it challenging to determine its true trend. Moving averages, on the other hand, provide a more stable and reliable indicator of the market's direction.

Let's take a look at the Bitcoin price chart with moving averages to better understand their significance. As of the latest data, we can observe the following patterns:

1. The 50-day moving average (SMA) serves as a critical support and resistance level. When Bitcoin's price falls below this level, it indicates a bearish trend, while a move above it suggests a bullish trend.

2. The 200-day moving average (SMA) acts as a long-term trend indicator. Traders often use this moving average to determine the overall market sentiment. A sustained move above the 200-day SMA is typically considered bullish, while a move below it is bearish.

3. The 100-day moving average (EMA) is another popular indicator that helps identify short-term trends. When Bitcoin's price crosses above or below this moving average, it can signal a potential change in the market's direction.

By analyzing the Bitcoin price chart with moving averages, we can identify several key patterns and signals:

1. Golden Cross: This occurs when the short-term moving average (e.g., 50-day SMA) crosses above the long-term moving average (e.g., 200-day SMA). It is considered a bullish signal and indicates that the market is gaining momentum.

2. Death Cross: The opposite of a golden cross, this pattern occurs when the short-term moving average crosses below the long-term moving average. It is a bearish signal and suggests that the market is losing momentum.

3. Divergence: This pattern occurs when the price of Bitcoin moves in one direction, while the moving averages move in the opposite direction. It can indicate a potential reversal in the market's trend.

In conclusion, the Bitcoin price chart with moving averages is a valuable tool for analyzing the cryptocurrency's performance. By understanding the significance of moving averages and identifying key patterns, traders and investors can make more informed decisions. However, it is essential to remember that moving averages are just one of many indicators available, and it is crucial to consider other factors before making any investment decisions.

This article address:https://www.binhlongphanthiet.com/blog/23f74999227.html

Like!(891)

Related Posts

- Bitcoin Price A: The Current State and Future Prospects

- Can Bitcoin Take Off?

- Best Bitcoin Cash Miner: Unveiling the Ultimate Choice for Crypto Enthusiasts

- The Neo Bitcoin Price: A Comprehensive Analysis

- Binance Smart Chain Ecosystem List: A Comprehensive Overview

- What Was the Price of 1 Bitcoin in 2010?

- Bitcoin Com Wallet App: A Comprehensive Guide to Managing Your Cryptocurrency

- What You Need to Sell Bitcoin on Cash App

- Bitcoin Price on December 29, 2020: A Look Back at a Historic Day

- How to Buy Token on Binance Smart Chain: A Step-by-Step Guide

Popular

Recent

Binance Trade History Export: A Comprehensive Guide to Managing Your Trading Data

Is It Safe to Buy Bitcoin on Cash App?

Bitcoin Inverse ETF Canada: A Game-Changer for Cryptocurrency Investors

Bitcoin Gold Price in 2019: A Comprehensive Analysis

Bitcoin Price Prediction After the Halving: What to Expect?

Bitcoin Price Hike Today: A Glimpse into the Cryptocurrency's Volatile Market

Can I Buy Solana on Binance US?

Bitcoin Philippines Price: A Comprehensive Look at the Cryptocurrency's Value in the Philippines

links

- Transfer Doge from Binance to Crypto.com: A Step-by-Step Guide

- Binance Buy vs Sell: A Comprehensive Guide to Making Informed Decisions

- How to Withdraw Bitcoin from Trust Wallet: A Step-by-Step Guide

- How Much Bitcoin Can You Receive on Cash App?

- The Impact of BCH/BTC on Binance: A Comprehensive Analysis

- List of All Binance Symbols Airdrops: A Comprehensive Guide

- How to Trade Isolated Margin on Binance: A Comprehensive Guide

- Bitcoin Cash Converter to ZAR: A Comprehensive Guide for South African Users

- Where to Convert Bitcoin to Cash: A Comprehensive Guide

- How to Make Money on Bitcoin Cash App: A Comprehensive Guide