You are here:Chùa Bình Long – Phan Thiết > news

Can I Claim Bitcoin as a Loss?

Chùa Bình Long – Phan Thiết2024-09-21 03:33:03【news】1people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has become a popular digital currency that has gained significant attention airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has become a popular digital currency that has gained significant attention

In recent years, Bitcoin has become a popular digital currency that has gained significant attention from investors and individuals alike. However, with the volatile nature of cryptocurrencies, many people have experienced significant losses. One common question that arises is whether individuals can claim Bitcoin as a loss on their taxes. In this article, we will explore the topic of claiming Bitcoin as a loss and provide some guidance on the matter.

Firstly, it is important to understand that Bitcoin is considered an asset for tax purposes. This means that any gains or losses from Bitcoin transactions are subject to taxation. According to the IRS, Bitcoin is classified as property, and any transactions involving Bitcoin are treated as property transactions.

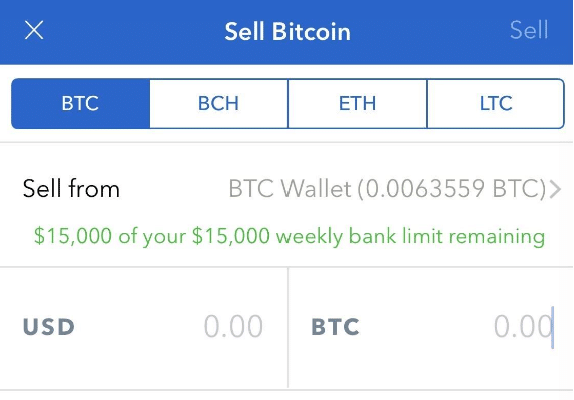

When it comes to claiming Bitcoin as a loss, there are a few key factors to consider. Firstly, you must have actually incurred a loss. This means that the value of your Bitcoin has decreased since you acquired it. If you purchased Bitcoin at $10,000 and its value dropped to $5,000, you have incurred a $5,000 loss.

Secondly, you must have held the Bitcoin for more than a year to qualify for long-term capital gains treatment. If you held the Bitcoin for less than a year, the loss would be considered a short-term capital loss and may have a different tax treatment.

To claim Bitcoin as a loss, you will need to report the loss on your tax return. This can be done by using Form 8949, which is used to report capital gains and losses. You will need to provide the following information on Form 8949:

1. The date you acquired the Bitcoin.

2. The date you sold or disposed of the Bitcoin.

3. The cost basis of the Bitcoin, which is the amount you paid for it.

4. The amount of the loss.

Once you have completed Form 8949, you will need to transfer the information to Schedule D of your tax return. Schedule D is used to summarize your capital gains and losses for the year.

It is important to note that claiming Bitcoin as a loss may have certain limitations. For example, if you have other capital gains during the same year, the loss may be offset against those gains. If the loss exceeds your capital gains, you may be able to deduct up to $3,000 of the loss from your ordinary income. Any remaining loss can be carried forward to future years and used to offset capital gains in those years.

However, there are some situations where you may not be able to claim Bitcoin as a loss. For instance, if you acquired the Bitcoin through a fraudulent scheme or if you received it as a gift, you may not be eligible to claim a loss.

In conclusion, if you have incurred a loss on Bitcoin, you may be able to claim it as a loss on your taxes. However, it is important to carefully follow the guidelines provided by the IRS and ensure that you meet all the necessary requirements. Consulting with a tax professional can be beneficial to ensure that you are correctly reporting your Bitcoin transactions and losses.

Remember, "Can I claim Bitcoin as a loss?" is a question that requires careful consideration of your specific circumstances. By understanding the rules and regulations surrounding cryptocurrency taxation, you can make informed decisions regarding your tax obligations.

This article address:https://www.binhlongphanthiet.com/blog/69b52299408.html

Like!(84652)

Related Posts

- Live Bitcoin Price Quotes: The Ultimate Guide to Tracking Cryptocurrency Value

- Title: Ensuring Secure and Efficient Bitcoin Mining with Trusted Bitcoin Mining Software

- Bitcoin Price on February 1, 2021: A Look Back at the Market Dynamics

- Vera Binance Smart Chain: Revolutionizing the Blockchain Ecosystem

- Buy Orders on Binance: A Comprehensive Guide to Trading on the World's Leading Cryptocurrency Exchange

- How to Withdraw Money from Bitcoin Wallet: A Comprehensive Guide

- Can You Cancel a Binance Withdrawal? Understanding the Process

- Why Can't I Sell AMP on Binance?

- How to Withdraw NiceHash to Binance: A Step-by-Step Guide

- Bitcoin Cash Price Analysis 2018: A Comprehensive Look Back

Popular

Recent

Title: Convert Bitcoin to Cash in Malaysia: A Comprehensive Guide

Keep Bitcoin Wallet Safe: Essential Tips for Secure Cryptocurrency Storage

Unlocking Financial Freedom with Bitcoin Wallet Telegram: A Comprehensive Guide

Why Can't I Sell AMP on Binance?

Bitcoin Price Before and After Halving: A Comprehensive Analysis

How to Add the Binance Smart Chain Network into Your MetaMask Wallet

Binance Buy Tokocrypto: A Comprehensive Guide to Investing in Cryptocurrency on Binance

Binance, Coinbase, and CoinMarketCap: The Triumvirate of Cryptocurrency

links

- Accessing Your Binance Chain Wallet: A Comprehensive Guide

- Bitcoin Cash BS Bitcoin: A Comparison of the Two Leading Cryptocurrencies

- Where to Buy Bitcoin Cash with Debit Card: A Comprehensive Guide

- Bitcoin Mining Pareri: The Controversy and Future of Cryptocurrency Mining

- Where Is Withdraw Bitcoin on Cash App: A Comprehensive Guide

- Why Can I Withdraw from Binance?

- How to Get a Wallet Address for Bitcoin: A Comprehensive Guide

- Bitcoin Wallet No Transaction Fee: The Future of Cryptocurrency Transactions

- The Rise of USDT to ARS Trading on Binance