You are here:Chùa Bình Long – Phan Thiết > markets

Can You Dollar Cost Average Bitcoin?

Chùa Bình Long – Phan Thiết2024-09-21 01:33:51【markets】4people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized digital currency, has been a topic of great interest and de airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized digital currency, has been a topic of great interest and de

Bitcoin, the world's first decentralized digital currency, has been a topic of great interest and debate among investors and enthusiasts alike. With its volatile nature and unpredictable price fluctuations, many individuals are left wondering whether they can effectively dollar cost average (DCA) Bitcoin. In this article, we will explore the concept of dollar cost averaging and its applicability to Bitcoin investments.

What is Dollar Cost Averaging?

Dollar cost averaging is an investment strategy where an individual invests a fixed amount of money at regular intervals, regardless of the market's price. The idea behind DCA is to reduce the impact of market volatility and minimize the risk of investing a large sum of money at the wrong time. By spreading out investments over time, investors can buy more shares when prices are low and fewer shares when prices are high, ultimately achieving a lower average cost per share.

Can You Dollar Cost Average Bitcoin?

Absolutely, you can dollar cost average Bitcoin. In fact, DCA is an excellent strategy for Bitcoin investors due to its inherent volatility. Here's why:

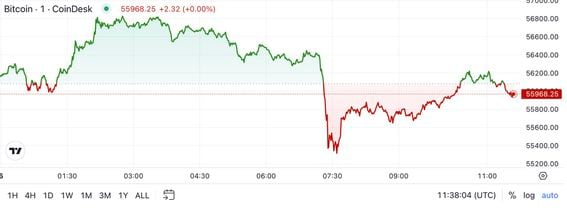

1. Volatility: Bitcoin's price has experienced significant fluctuations over the years. By dollar cost averaging, you can reduce the impact of these price swings and avoid the emotional rollercoaster of trying to time the market.

2. Risk Management: DCA helps to manage risk by ensuring that you are consistently investing in Bitcoin, regardless of its current price. This approach can help mitigate the risk of investing a large sum of money at a peak and potentially losing a significant portion of your investment.

3. Long-term Perspective: Dollar cost averaging encourages a long-term perspective on your Bitcoin investment. By consistently investing over time, you can avoid the temptation to react impulsively to short-term market movements.

How to Dollar Cost Average Bitcoin

To dollar cost average Bitcoin, follow these simple steps:

1. Determine your investment amount: Decide on the fixed amount of money you want to invest in Bitcoin each month or quarter.

2. Choose a regular investment schedule: Decide on the frequency of your investments, whether it's monthly, quarterly, or another interval that suits your financial situation.

3. Execute your investments: Use a cryptocurrency exchange or a Bitcoin wallet that allows you to set up automatic recurring investments. This will ensure that you consistently invest in Bitcoin at your chosen intervals.

4. Track your investments: Keep a record of your investments and monitor your Bitcoin portfolio's performance over time. This will help you stay informed about your investment strategy and make adjustments if necessary.

In conclusion, dollar cost averaging is a viable strategy for Bitcoin investors looking to mitigate risk and reduce the impact of market volatility. By consistently investing a fixed amount of money over time, you can achieve a lower average cost per Bitcoin and potentially benefit from the long-term growth of the cryptocurrency market. So, can you dollar cost average Bitcoin? The answer is a resounding yes!

This article address:https://www.binhlongphanthiet.com/blog/7b69599297.html

Like!(294)

Related Posts

- Electrum Wallet Bitcoin Cash Transaction Legacy Address: A Comprehensive Guide

- Getting Bitcoin Miner Android to Wallet: A Comprehensive Guide

- Bitcoin Cash App Fees: Understanding the Cost of Using the Popular Cryptocurrency Platform

- Binance Smart Chain Binance US: The Future of Blockchain Technology

- How to Mining Bitcoin Private: A Comprehensive Guide

- How Long Does a Bitcoin Transaction Take on Binance?

- Binance Community Coin Vote Round 5: A Milestone in the Cryptocurrency Ecosystem

- Binance or Bitfinex Trading: A Comprehensive Comparison

- Bitcoin Price USD History Chart: A Comprehensive Overview

- ### The Intersection of Bitcoin Mining and Forex Trade

Popular

Recent

Bitcoin Price Throughout the Years: A Journey of Volatility and Growth

Is Bitcoin Insured on Cash App?

How Long Does a Bitcoin Transaction Take on Binance?

The Current Price of Bitcoin Private: A Closer Look

How Super Bitcoin Mining with PC Software Can Boost Your Earnings

**Maximizing Your Bitcoin Mining Potential with the Right Mining App

How to Send Bitcoin from Binance to Coinbase: A Step-by-Step Guide

Que Son Los Bitcoin Cash: A Comprehensive Guide

links

- Bitcoin Price Prediction Using Python Code: A Comprehensive Guide

- Why Binance Coin is Growing

- Bitcoin Mining is Not Profitable: The Reality Behind the Hype

- Can I Buy Bitcoin on Scottrade?

- How to Mining Bitcoin Private: A Comprehensive Guide

- Genesis Mining Bitcoin: A Comprehensive Guide to the Leading Cryptocurrency Mining Company

- Bitcoin Price Before and After Halving: A Comprehensive Analysis

- Free Bitcoin Cash App Como Funciona: A Comprehensive Guide

- Recovering a Bitcoin Wallet: A Step-by-Step Guide

- Bitcoin Wallet Cracker: A Deep Dive into the World of Cryptocurrency Security Breaches