You are here:Chùa Bình Long – Phan Thiết > airdrop

Bitcoin Mining Canada Tax: Understanding the Implications and Legalities

Chùa Bình Long – Phan Thiết2024-09-21 01:35:38【airdrop】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin mining has become a popular activity in Canada, with many individuals and businesses partici airdrop,dex,cex,markets,trade value chart,buy,Bitcoin mining has become a popular activity in Canada, with many individuals and businesses partici

Bitcoin mining has become a popular activity in Canada, with many individuals and businesses participating in the process of validating transactions and earning cryptocurrency rewards. However, with the rise of this digital gold rush, the question of Bitcoin mining Canada tax has become a crucial topic for both miners and tax authorities. In this article, we will delve into the implications and legalities surrounding Bitcoin mining Canada tax.

Firstly, it is important to understand that Bitcoin mining is not a taxable event in Canada. Unlike traditional forms of income, such as employment or business profits, Bitcoin mining does not generate taxable income until the cryptocurrency is sold or exchanged for fiat currency. This means that the act of mining Bitcoin itself is not subject to Bitcoin mining Canada tax.

However, when it comes to the taxation of Bitcoin mining Canada, the situation becomes more complex. Once a miner decides to convert their earned Bitcoin into Canadian dollars or another fiat currency, they are then required to report the proceeds as income on their tax returns. This is where the Bitcoin mining Canada tax implications come into play.

The Canadian Revenue Agency (CRA) considers Bitcoin and other cryptocurrencies as property, rather than currency. As such, the gains or losses from the sale of Bitcoin are subject to capital gains tax. The capital gains tax rate in Canada varies depending on the individual's total income, with the highest rate being approximately 33% for those earning over $210,000.

To calculate the capital gains tax on Bitcoin mining Canada, miners must determine the cost basis of their cryptocurrency. The cost basis is typically the amount of money invested in the mining equipment, electricity, and other related expenses. When the Bitcoin is sold, the difference between the selling price and the cost basis is considered the capital gain or loss.

It is important for Bitcoin miners to keep detailed records of their expenses and earnings to accurately calculate their capital gains tax liability. This includes tracking the cost of mining equipment, electricity consumption, and any other relevant expenses. Failure to do so may result in penalties or audits by the CRA.

In addition to capital gains tax, Bitcoin mining Canada tax may also be subject to other taxes, depending on the individual's circumstances. For example, if a miner is using their home as a mining operation, they may be eligible for a home office deduction, which can help offset some of their expenses.

Furthermore, it is worth noting that the CRA has been actively monitoring the cryptocurrency market and has issued guidelines on the taxation of Bitcoin and other cryptocurrencies. These guidelines provide clarity on the legalities surrounding Bitcoin mining Canada tax and help ensure that miners are compliant with tax regulations.

In conclusion, while Bitcoin mining itself is not subject to Bitcoin mining Canada tax, the conversion of earned cryptocurrency into fiat currency is subject to capital gains tax. Miners must keep detailed records of their expenses and earnings to accurately calculate their tax liability. By understanding the implications and legalities of Bitcoin mining Canada tax, miners can ensure compliance with tax regulations and avoid potential penalties or audits.

This article address:https://www.binhlongphanthiet.com/blog/91a62499284.html

Like!(8992)

Related Posts

- How Much I Can Earn from Bitcoin Mining: A Comprehensive Guide

- Buy Bitcoin Miner Canada: A Comprehensive Guide to Investing in Cryptocurrency Mining

- GTX 1050Ti SC ACX Single Bitcoin Mining: A Comprehensive Guide

- VIP Pump Binance Crypto: The Ultimate Guide to Leveraging VIP Opportunities in the Cryptocurrency Market

- Binance BTC LTC: A Comprehensive Guide to Trading on Binance

- Bitcoin Price and BAT Token: A Comprehensive Analysis

- Title: Enhancing Your Bitcoin Mining Experience with the Best Bitcoin Mining Tool for Windows

- Understanding the Role of Ters in a Bitcoin Cash Address

- Bitcoin Price A: The Current State and Future Prospects

- Mark Price Meaning Binance: Understanding the Significance of Mark Price in the Cryptocurrency Exchange

Popular

Recent

Can Windows Defender Detect Bitcoin Miner?

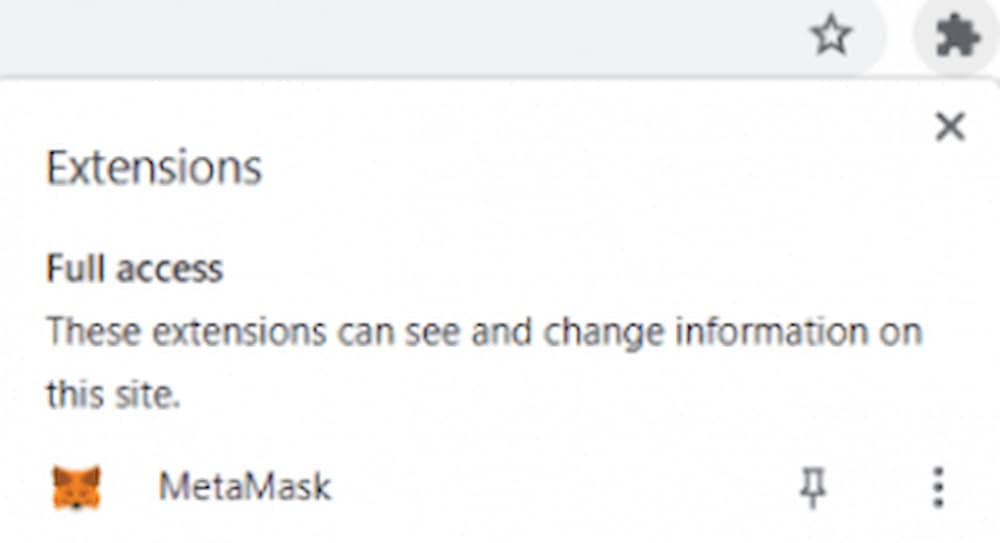

**How to Configure MetaMask for Binance Smart Chain: A Step-by-Step Guide

Windows 10 Bitcoin Mining Software Intel HD 4600: A Comprehensive Guide

Turkey Mining Bitcoin: A Booming Trend in the Cryptocurrency World

Title: Unveiling the Power of the Claim Bitcoin Wallet APK: A Comprehensive Guide

GTX 1050Ti SC ACX Single Bitcoin Mining: A Comprehensive Guide

How to Transfer NEO on Binance to Neon Wallet: A Step-by-Step Guide

Buy Bitcoin Cash with Green Dot Prepaid Card: A Comprehensive Guide

links

- Square Bitcoin Cash: A Game-Changing Cryptocurrency Integration

- Trading Bitcoins for Cash: A Comprehensive Guide

- What is Binance Chain Wallet?

- Can U Transfer Bitcoin to Cash?

- How to Send Bitcoin from Exchange to Wallet: A Step-by-Step Guide

- **Lista de Criptomoedas da Binance: A Comprehensive Guide to Binance's Cryptocurrency Offerings

- What Was the Price of Bitcoin Today: A Comprehensive Analysis

- The Price for a Bitcoin: A Journey Through the Cryptocurrency Landscape

- What is Bitcoin Mining Video: Unveiling the World of Cryptocurrency Mining

- Trading Bitcoins for Cash: A Comprehensive Guide