You are here:Chùa Bình Long – Phan Thiết > bitcoin

The First Bitcoin Capital Price: A Milestone in Cryptocurrency History

Chùa Bình Long – Phan Thiết2024-09-20 22:44:31【bitcoin】4people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The first Bitcoin capital price, often referred to as the "first Bitcoin capital price," marked a si airdrop,dex,cex,markets,trade value chart,buy,The first Bitcoin capital price, often referred to as the "first Bitcoin capital price," marked a si

The first Bitcoin capital price, often referred to as the "first Bitcoin capital price," marked a significant milestone in the history of cryptocurrency. It was the moment when Bitcoin, the pioneering digital currency, gained recognition as a legitimate asset class. This article delves into the background of the first Bitcoin capital price, its implications, and its impact on the cryptocurrency market.

The first Bitcoin capital price was recorded on May 22, 2010, when a programmer named Laszlo Hanyecz purchased two pizzas for 10,000 Bitcoin. At that time, the value of Bitcoin was negligible, and the transaction was considered a novelty. However, this event laid the foundation for the future of Bitcoin and its capital price.

The first Bitcoin capital price was a mere fraction of what it is today. In 2010, Bitcoin was worth just a few cents per unit. Fast forward to 2021, and the value of Bitcoin has skyrocketed, reaching an all-time high of over $60,000. This meteoric rise in value can be attributed to several factors, including increased adoption, regulatory clarity, and the growing belief in the potential of decentralized finance.

The first Bitcoin capital price serves as a testament to the resilience and potential of Bitcoin. Despite its humble beginnings, Bitcoin has managed to carve out a niche for itself in the financial world. This is a testament to the vision of its creator, Satoshi Nakamoto, who envisioned a decentralized digital currency that could operate independently of traditional financial institutions.

The implications of the first Bitcoin capital price are vast. It has paved the way for the growth of the cryptocurrency market, which now includes thousands of different digital assets. The first Bitcoin capital price has also sparked a global conversation about the future of money and finance. As more people become aware of the potential of cryptocurrencies, the demand for these assets continues to rise.

One of the key reasons for the rise in the first Bitcoin capital price is the growing acceptance of Bitcoin as a legitimate investment. Many institutional investors have started to allocate a portion of their portfolios to Bitcoin, viewing it as a hedge against inflation and a store of value. This institutional interest has driven the price of Bitcoin to new heights, and it is likely to continue doing so in the future.

The first Bitcoin capital price has also had a ripple effect on other cryptocurrencies. As Bitcoin has gained traction, so too have altcoins, which are digital assets that are not Bitcoin. These altcoins have seen significant growth in value, with some achieving market capitalizations that rival those of traditional stocks.

However, the first Bitcoin capital price has also brought about challenges. The volatility of cryptocurrencies has led to concerns about their suitability as an investment. Additionally, the regulatory landscape remains uncertain, with governments around the world grappling with how to regulate this emerging asset class.

In conclusion, the first Bitcoin capital price was a pivotal moment in the history of cryptocurrency. It marked the beginning of a new era, where digital currencies could challenge traditional financial systems. As Bitcoin continues to grow and evolve, its first capital price will remain a reminder of the potential of this groundbreaking technology. The future of the first Bitcoin capital price is bright, and it is likely to continue to rise as more people recognize the value of this innovative asset.

This article address:https://www.binhlongphanthiet.com/eth/10b6199928.html

Like!(764)

Previous: Why Is Bitcoin Cash Up So Much?

Related Posts

- Do I Have to Report Bitcoin Wallet Ownership?

- Bitcoin Galaxy Mining: The Future of Cryptocurrency Mining

- How to Sell Bitcoin on Cash App: A Step-by-Step Guide

- **Understanding the Bitcoin Short-Term Holder Realized Price: A Key Metric for Market Analysis

- Binance New Listing Today: Exciting New Cryptocurrencies to Watch Out For

- Why Bitcoin Price is Going Up

- HNT Coin Binance Delist: The Impact on the Market and Investors

- Binance Coinbase Stake: A Comprehensive Guide to Understanding the Intersection of Two Leading Cryptocurrency Platforms

- ### Metamask Binance Chain Network: A Gateway to Decentralized Finance

- Bitcoin Galaxy Mining: The Future of Cryptocurrency Mining

Popular

- The Historical Price Chart of Bitcoin: A Journey Through Time

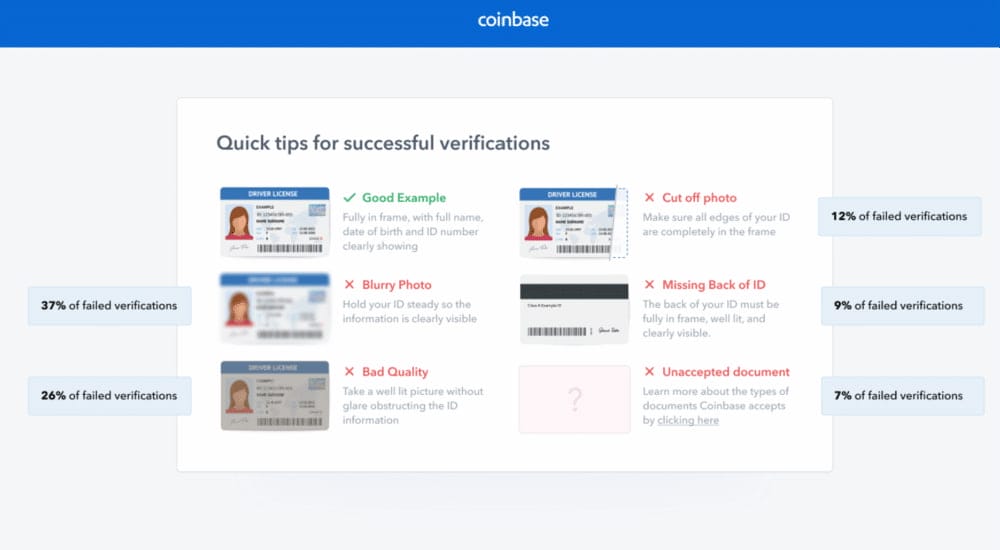

- Mining Bitcoin on Coinbase: A Comprehensive Guide to Cryptocurrency Mining on the Platform

- Moving Crypto from Robinhood to Binance: A Comprehensive Guide

- Coinbase Bitcoin Wallet: A Secure and User-Friendly Solution for Cryptocurrency Storage

Recent

Bitcoin Cash Spot Price: A Comprehensive Analysis

Bitcoin Cash Fork October: A Milestone in the Cryptocurrency World

Top 20 Bitcoin Wallet Holders: Who Are They and What Do They Own?

Kroger Accepts Bitcoin Cash: A New Era of Digital Payments

Bitcoin Price Prediction Summer 2022: What to Expect

Bitcoin Volcano Mining: A Revolutionary Approach to Cryptocurrency Extraction

What Happens to Bitcoins Stored in a Private Wallet?

What is happening when Bitcoin stop mining?

links

- Bitcoin Mining with a Normal PC: Is It Possible?

- Can Steam Cards Be Used for Bitcoin?

- Can I Buy Bitcoin at a Bank?

- Bitcoin Current Market Price: A Comprehensive Analysis

- **Understanding the Fee Structure for Coin Conversion on Binance

- The Rise of Backpage Bitcoin Cash: A New Era of Online Transactions

- **Exploring the New Binance Crypto Listings: A Gateway to Diverse Investment Opportunities

- How Will Segwit Affect Bitcoin Price?

- Why Does the Bitcoin Price Change?

- What OS is Bitcoin Mining?