You are here:Chùa Bình Long – Phan Thiết > markets

How to Price Bitcoin: A Comprehensive Guide

Chùa Bình Long – Phan Thiết2024-09-20 23:42:51【markets】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized digital currency, has gained immense popularity over the ye airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized digital currency, has gained immense popularity over the ye

Bitcoin, the world's first decentralized digital currency, has gained immense popularity over the years. As the demand for this cryptocurrency continues to rise, many individuals and investors are eager to understand how to price Bitcoin. In this article, we will explore various factors that influence Bitcoin's price and provide you with a comprehensive guide on how to price Bitcoin.

1. Understanding Bitcoin's Supply and Demand

The supply and demand of Bitcoin play a crucial role in determining its price. Bitcoin has a fixed supply of 21 million coins, which is predetermined by its algorithm. As the supply remains constant, the price is influenced by the demand for Bitcoin.

To price Bitcoin, you need to analyze the market demand. This involves studying factors such as:

a. Adoption rate: The number of individuals and businesses accepting Bitcoin as a payment method.

b. Market sentiment: The overall perception of Bitcoin among investors and the public.

c. Regulatory environment: The stance of governments and regulatory bodies towards cryptocurrencies.

2. Analyzing Market Trends

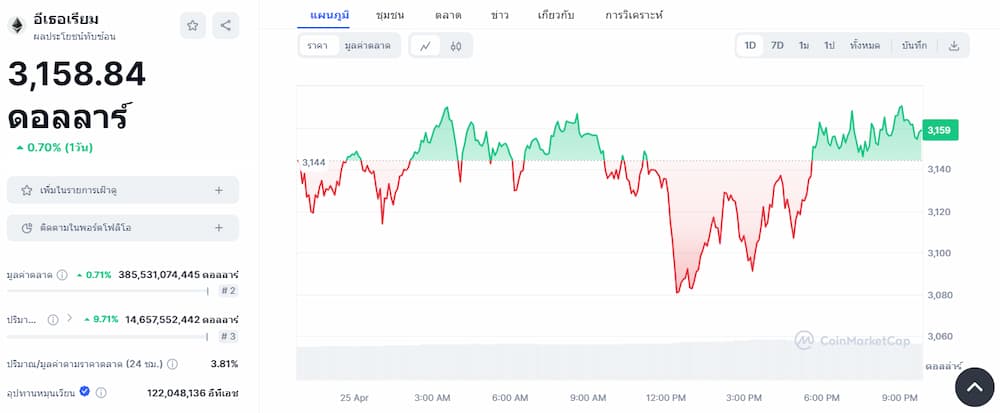

Bitcoin's price is subject to volatility, and understanding market trends is essential for pricing Bitcoin accurately. Here are some key trends to consider:

a. Historical data: Analyzing past price movements can help identify patterns and potential future trends.

b. Seasonal trends: Bitcoin's price often experiences seasonal fluctuations, such as increased demand during bull markets and decreased demand during bear markets.

c. Market sentiment indicators: Sentiment indicators, such as the Bitcoin Fear & Greed Index, can provide insights into market trends.

3. Evaluating Bitcoin's Intrinsic Value

In addition to supply and demand, Bitcoin's intrinsic value is another crucial factor in pricing. Here are some methods to evaluate Bitcoin's intrinsic value:

a. Network value to transaction ratio: This metric compares the total value of Bitcoin in circulation to the total number of transactions processed on the network. A lower ratio suggests a higher intrinsic value.

b. Market capitalization: Bitcoin's market capitalization is calculated by multiplying its current price by the total number of coins in circulation. This metric provides an indication of Bitcoin's overall value in the market.

c. Economic indicators: Analyzing economic indicators, such as inflation rates and currency devaluation, can help determine Bitcoin's potential as a store of value.

4. Utilizing Technical Analysis

Technical analysis involves studying historical price data and using various tools and indicators to predict future price movements. Here are some popular technical analysis tools for pricing Bitcoin:

a. Moving averages: These indicators help identify trends and potential support/resistance levels.

b. Bollinger Bands: This tool provides insights into volatility and potential price movements.

c. Fibonacci retracement levels: These levels help identify potential reversal points in the market.

5. Considering External Factors

Several external factors can impact Bitcoin's price, including:

a. Global economic conditions: Economic downturns or crises can lead to increased demand for Bitcoin as a safe haven asset.

b. Technological advancements: Innovations in blockchain technology can positively impact Bitcoin's price.

c. Regulatory news: Changes in the regulatory landscape can significantly affect Bitcoin's price.

In conclusion, pricing Bitcoin requires a comprehensive understanding of various factors, including supply and demand, market trends, intrinsic value, technical analysis, and external factors. By analyzing these elements, you can make more informed decisions when pricing Bitcoin. Remember that cryptocurrency markets are highly volatile, and it's essential to stay updated with the latest news and developments to make accurate pricing predictions.

This article address:https://www.binhlongphanthiet.com/eth/10d71599274.html

Like!(91537)

Related Posts

- Bitcoin Cash Easy Miner: A Game-Changer for Cryptocurrency Mining

- Binance Crypto Exchange App: The Ultimate Guide to Trading Cryptocurrencies on the Go

- Binance Wallet ERC20: A Comprehensive Guide to Managing Your Crypto Assets

- Bitcoin Cash Price Euro: A Comprehensive Analysis

- Bitcoin Machines in Canada: A Growing Trend in the Financial Landscape

- How to Deposit Bitcoin on Binance: A Step-by-Step Guide

- Binance Wallet ERC20: A Comprehensive Guide to Managing Your Crypto Assets

- The Rise of New Wallet Bitcoin: A Secure and Convenient Digital Asset Storage Solution

- Can I Buy Bitcoin with BitGo?

- Can You Buy RPX on Binance? A Comprehensive Guide

Popular

Recent

Bitcoin from Robinhood to Wallet: The Evolution of Cryptocurrency Investment

Bitcoin Price Falling in July: What It Means for the Market

Can I Send Bitcoin from Faucethub to Coinbase?

China Reconsiders Its Role in Bitcoin Mining

The Rise of the Bitcoin Wallet Startup: Revolutionizing Cryptocurrency Management

### Metamask on Binance Smart Chain: A Comprehensive Guide to Enhanced Crypto Experience

What Price Was Bitcoin When Tesla Bought?

China Reconsiders Its Role in Bitcoin Mining

links

- Hive Bitcoin Wallet: A Secure and User-Friendly Solution for Cryptocurrency Storage

- Binance Bitcoin Fee: Understanding the Cost of Trading on the World's Largest Cryptocurrency Exchange

- Buy Bitcoin Australia Best Price: A Comprehensive Guide to Finding the Lowest Costs

- Does Bitcoin Cash Use Segwit?

- Where Can I Buy a Bitcoin Wallet: A Comprehensive Guide

- WannaCry Wallet Bitcoin: The Intersection of Cybersecurity and Cryptocurrency

- Bitcoin Mining College Dorm: A Trend That's Taking the Educational World by Storm

- Title: How to Send Skrill to Bitcoin Wallet: A Comprehensive Guide

- Binance Smart Chain Liquidity: The Cornerstone of Decentralized Finance

- Bitcoin Wallet Test: Ensuring Security and Efficiency in Cryptocurrency Management