You are here:Chùa Bình Long – Phan Thiết > block

What Sets the Price of a Bitcoin?

Chùa Bình Long – Phan Thiết2024-09-20 22:41:14【block】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market has been a topic of intense interest and debate over the years. Among the airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market has been a topic of intense interest and debate over the years. Among the

The cryptocurrency market has been a topic of intense interest and debate over the years. Among the various cryptocurrencies, Bitcoin remains the most prominent and influential. Its price has been volatile, skyrocketing at times and plummeting at others. But what sets the price of a Bitcoin? This article aims to explore the factors that influence the value of Bitcoin.

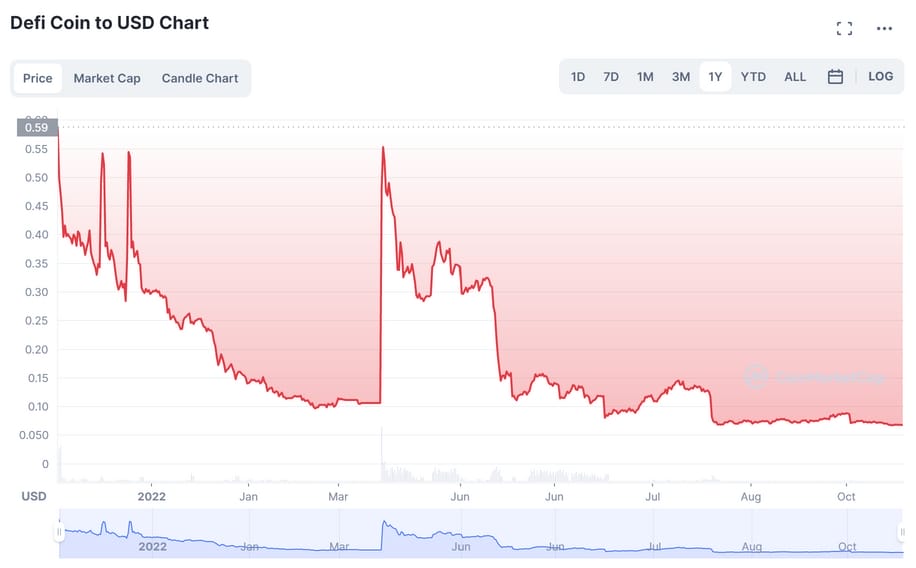

First and foremost, supply and demand play a crucial role in determining the price of a Bitcoin. As the most popular cryptocurrency, Bitcoin has a finite supply of 21 million coins. This scarcity has made Bitcoin a valuable asset, as the demand for it continues to grow. When more people want to buy Bitcoin, its price tends to rise. Conversely, if the demand decreases, the price may fall. This supply and demand dynamic is similar to that of other commodities, such as gold and oil.

Another factor that sets the price of a Bitcoin is the overall sentiment in the market. The cryptocurrency market is highly speculative, and investors' emotions can significantly impact the price. For instance, during the 2017 bull run, Bitcoin's price surged to an all-time high of nearly $20,000. This was driven by a wave of optimism and FOMO (fear of missing out) among investors. However, when the market started to cool down, Bitcoin's price plummeted.

Regulatory news and policies also play a significant role in determining the price of a Bitcoin. Governments and regulatory bodies around the world have varying stances on cryptocurrencies. In some countries, Bitcoin is legal and widely accepted, while in others, it is banned or heavily regulated. For instance, China's decision to ban Bitcoin mining in 2021 had a significant impact on the price of Bitcoin, as it reduced the supply of new coins entering the market.

Moreover, technological advancements and innovations can also influence the price of a Bitcoin. The blockchain technology underlying Bitcoin has the potential to revolutionize various industries, including finance, healthcare, and supply chain management. As more businesses and organizations adopt blockchain technology, the demand for Bitcoin may increase, potentially driving up its price.

The level of adoption of Bitcoin as a means of payment is another factor that sets its price. As more retailers and businesses accept Bitcoin as a payment method, its utility as a currency increases. This can lead to a higher demand for Bitcoin, which in turn can drive up its price.

Lastly, the performance of other cryptocurrencies can also impact the price of a Bitcoin. The cryptocurrency market is interconnected, and the success of one cryptocurrency can influence the sentiment and value of others. For instance, when Ethereum's price surged in 2021, it had a positive spillover effect on Bitcoin's price.

In conclusion, the price of a Bitcoin is influenced by a variety of factors, including supply and demand, market sentiment, regulatory news, technological advancements, adoption as a payment method, and the performance of other cryptocurrencies. Understanding these factors can help investors make informed decisions and navigate the volatile cryptocurrency market. However, it is essential to remember that investing in cryptocurrencies involves risks, and it is crucial to conduct thorough research before making any investment decisions.

This article address:https://www.binhlongphanthiet.com/eth/41a75499204.html

Like!(85325)

Related Posts

- Circle Invest Bitcoin Cash: A Game-Changer in the Crypto World

- **Mining Bitcoin Gratis Tanpa Deposit 2019 Legit: A Comprehensive Guide

- The Best Bitcoin Wallet App with Multi-Sig for Android: Secure Your Cryptocurrency with Ease

- The Ongoing Battle: Price vs Difficulty in the Bitcoin Ecosystem

- Title: The Process of Depositing AMB Coin into Your Binance Account

- Bitcoin Price Analysis: Coindesk's Insight into the Cryptocurrency Market

- Bitcoin Price and Chart with Volume: A Comprehensive Analysis

- Why Is Bitcoin Cash Bad?

- How to Use Binance to Trade: A Comprehensive Guide

- Bitcoin Mining Come Funziona: Understanding the Process of Mining Cryptocurrency

Popular

Recent

Binance Buy Ripple with USD: A Comprehensive Guide

Crypto Wallet Bitcoin Cash: A Secure and Versatile Solution for Digital Currency Holders

Binance Coin Outlook: A Comprehensive Analysis of the Future of BNB

Bitcoin Wallet Wikipedia: A Comprehensive Guide to Managing Your Cryptocurrency

Bitcoin Mining Calculator 2022: A Comprehensive Guide to Estimating Your Profits

The Rise of BTC Binance Spot: A Game-Changer in Cryptocurrency Trading

Nox Player Bitcoin Mining: A Comprehensive Guide

Bitcoin Price Chart in INR: A Comprehensive Analysis

links

- Binance Ripple Withdrawal: A Comprehensive Guide

- Mining Bitcoin in 2017: A Look Back at the Golden Age of Cryptocurrency

- Isle of Man Bitcoin Mining: A Booming Industry in the British Isles

- How to Buy Crypto with Debit Card on Binance: A Step-by-Step Guide

- Binance U.S. App: A Comprehensive Guide to Trading Cryptocurrency on the Go

- Ledger Bitcoin Cash Send: A Secure and Convenient Way to Transfer Cryptocurrency

- How to Request Bitcoin Cash from Coinbase: A Step-by-Step Guide

- Why Bitcoin Cash Crashed: A Comprehensive Analysis

- What Makes a Good Bitcoin Mining Rig: A Comprehensive Guide

- Can I Send ETH from Binance to Metamask Using BEP20?