You are here:Chùa Bình Long – Phan Thiết > airdrop

The Bitcoin Fund Stock Price: A Comprehensive Analysis

Chùa Bình Long – Phan Thiết2024-09-21 01:48:17【airdrop】7people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has seen a surge in popularity, with Bitcoin leading the airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has seen a surge in popularity, with Bitcoin leading the

In recent years, the cryptocurrency market has seen a surge in popularity, with Bitcoin leading the charge. As a result, numerous investment funds have been established to provide investors with exposure to the volatile yet potentially lucrative Bitcoin market. One such fund is the Bitcoin Fund, which has seen its stock price attract significant attention from both retail and institutional investors. This article aims to provide a comprehensive analysis of the Bitcoin Fund stock price, exploring its factors, trends, and future prospects.

The Bitcoin Fund Stock Price: An Overview

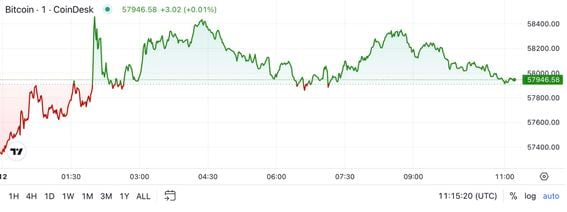

The Bitcoin Fund stock price, often referred to as the "BTC Fund" or "BTCX," represents the value of shares in a mutual fund or exchange-traded fund (ETF) that invests primarily in Bitcoin. The stock price is influenced by various factors, including market demand, regulatory changes, and the overall performance of the cryptocurrency market.

Factors Influencing the Bitcoin Fund Stock Price

1. Market Demand: The demand for Bitcoin and, by extension, the Bitcoin Fund stock, is a primary driver of its price. As more individuals and institutions recognize the potential of Bitcoin as a digital asset, the demand for the fund's shares may increase, leading to a rise in its stock price.

2. Regulatory Changes: The regulatory landscape plays a crucial role in the Bitcoin Fund stock price. Positive regulatory news, such as the approval of Bitcoin ETFs in major markets, can boost investor confidence and drive up the stock price. Conversely, negative news or increased regulatory scrutiny may lead to a decline in the stock price.

3. Cryptocurrency Market Performance: The performance of the broader cryptocurrency market directly impacts the Bitcoin Fund stock price. Since the fund is heavily invested in Bitcoin, its stock price tends to mirror the price movements of the cryptocurrency. In times of market optimism, the stock price may rise, while during bear markets, it may fall.

Trends in the Bitcoin Fund Stock Price

Over the past few years, the Bitcoin Fund stock price has exhibited several notable trends:

1. Volatility: The stock price has been highly volatile, reflecting the inherent volatility of the cryptocurrency market. This volatility can create opportunities for investors to buy low and sell high, but it also poses significant risks.

2. Correlation with Bitcoin Price: The Bitcoin Fund stock price has shown a strong correlation with the price of Bitcoin. When Bitcoin's price increases, the stock price tends to rise, and vice versa.

3. Regulatory Milestones: Milestones in the regulatory landscape, such as the approval of Bitcoin ETFs, have had a significant impact on the stock price, often leading to upward trends.

Future Prospects for the Bitcoin Fund Stock Price

The future of the Bitcoin Fund stock price remains uncertain, but several factors may influence its trajectory:

1. Market Adoption: As more individuals and institutions adopt Bitcoin as an investment vehicle, the demand for the Bitcoin Fund stock may continue to grow, potentially driving up its price.

2. Regulatory Environment: The regulatory environment will play a crucial role in shaping the future of the Bitcoin Fund stock price. Positive regulatory news is likely to support the stock price, while negative news may lead to downward trends.

3. Technological Advancements: Technological advancements in the cryptocurrency space, such as improved scalability and security, may enhance investor confidence and contribute to a rise in the stock price.

In conclusion, the Bitcoin Fund stock price is influenced by a variety of factors, including market demand, regulatory changes, and the performance of the cryptocurrency market. While the stock price has been volatile, it has shown a strong correlation with the price of Bitcoin. As the market continues to evolve, investors should stay informed about the latest trends and developments to make informed decisions regarding their investments in the Bitcoin Fund stock price.

This article address:https://www.binhlongphanthiet.com/eth/70a81599114.html

Like!(5)

Related Posts

- Connecting Metamask to Binance Smart Chain: A Comprehensive Guide from Binance Academy

- Bitcoin Price in India: A Journey Through the Decades

- Best Coin to Invest in 2022: Binance's Top Pick

- Top Bitcoin Mining Software for Windows: Unveiling the Best Options

- 015 Bitcoin to Cash: The Intersection of Digital Currency and Traditional Transactions

- Best Desktop Bitcoin Wallet Mac: The Ultimate Guide to Secure Crypto Storage

- Binance, one of the leading cryptocurrency exchanges in the world, offers a wide range of services to its users, including the ability to withdraw USD from their accounts. The USD withdrawal process on Binance is straightforward and designed to be user-friendly, making it an attractive option for traders and investors looking to convert their crypto holdings into fiat currency.

- Coinmarketcap Bitcoin Cash: A Comprehensive Analysis

- The Importance of Bitcoin Password Wallet: Safeguarding Your Cryptocurrency

- Bitcoin Price in 2009: A Journey Through the Early Days of Cryptocurrency

Popular

Recent

Bitcoin Price Early 2017: A Look Back at the Cryptocurrency's Rapid Rise

How to See What Price You Bought at Binance: A Comprehensive Guide

Best Bitcoin Hardware Wallet 2015: A Comprehensive Guide

coinbase

Mining Bitcoin with Excel: A Surprising Approach to Cryptocurrency Extraction

Title: Exploring Bitcoin Price with VB.NET

Bitcoin Mining Equipment Amazon: The Ultimate Guide to Finding the Best Products

Bitcoin Cash Using Credit Card: A New Era of Digital Transactions

links

- Bitcoin Cash Wallet Price: A Comprehensive Analysis

- Make Bitcoins Without Mining: Exploring Alternative Methods

- Bitcoin Wallet 2011: The Pioneering Tool That Shaped Cryptocurrency Storage

- Rising Bitcoin Prices: A Game-Changing Trend in the Cryptocurrency Market

- How to See Bitcoin Wallet Address on Coinbase: A Comprehensive Guide

- Is Bitcoin Mining Haram?

- Bitcoin Mining Seattle: A Thriving Community in the Emerald City

- When Can You Deposit into Binance: A Comprehensive Guide

- Bitcoin Cash Wallet Coin: The Ultimate Guide to Managing Your Digital Assets

- Binance Chain BTC: The Future of Cryptocurrency Integration