You are here:Chùa Bình Long – Phan Thiết > chart

Binance Maker Taker Trading Fees: Understanding the Structure and Impact on Traders

Chùa Bình Long – Phan Thiết2024-09-20 23:42:52【chart】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the rapidly evolving world of cryptocurrency trading, Binance has emerged as one of the leading p airdrop,dex,cex,markets,trade value chart,buy,In the rapidly evolving world of cryptocurrency trading, Binance has emerged as one of the leading p

In the rapidly evolving world of cryptocurrency trading, Binance has emerged as one of the leading platforms, attracting millions of users worldwide. One of the key aspects that traders consider when choosing a trading platform is the fee structure. Binance offers a unique fee structure that differentiates between makers and takers, which can significantly impact traders' profitability. In this article, we will delve into the Binance Maker Taker Trading Fees, their structure, and their impact on traders.

What are Binance Maker Taker Trading Fees?

Binance Maker Taker Trading Fees refer to the fees charged by Binance for executing trades on its platform. The fees are structured differently for makers and takers, with makers being rewarded for providing liquidity to the market, while takers are charged for taking liquidity from the market.

Makers are traders who place limit orders that are filled by other traders' market orders. In other words, they are providing liquidity to the market. Takers, on the other hand, are traders who place market orders that are filled immediately by the best available limit orders in the order book. They are taking liquidity from the market.

Structure of Binance Maker Taker Trading Fees

Binance's fee structure is designed to incentivize liquidity provision and discourage excessive market-making. The fees are tiered based on the trading volume of the user, with higher trading volume users enjoying lower fees. Here's a breakdown of the fee structure:

1. Maker Fees: Makers are charged a fee of 0.015% for each trade. However, this fee is reduced to 0.01% for users with a 30-day trading volume of over 1,500 BTC or its equivalent in other cryptocurrencies.

2. Taker Fees: Takers are charged a fee of 0.020% for each trade. This fee is reduced to 0.018% for users with a 30-day trading volume of over 1,500 BTC or its equivalent in other cryptocurrencies.

Impact on Traders

The Binance Maker Taker Trading Fees can have a significant impact on traders, depending on their trading strategies and volume.

1. Incentivizing Liquidity Provision: By offering lower fees to makers, Binance encourages users to provide liquidity to the market. This leads to a more efficient and liquid market, benefiting all traders.

2. Discouraging Excessive Market-Making: The higher fees for takers help discourage excessive market-making, which can lead to market manipulation and volatility. This ensures a fair and transparent trading environment.

3. Cost-Effective Trading: Traders with high trading volumes can benefit from lower fees, making Binance a cost-effective platform for large-scale trading.

4. Profitability: Traders who are successful in providing liquidity to the market can enjoy lower fees, leading to increased profitability.

Conclusion

Binance Maker Taker Trading Fees play a crucial role in shaping the trading experience on the platform. By incentivizing liquidity provision and discouraging excessive market-making, Binance has created a fair and efficient trading environment. Understanding the fee structure and its impact on traders is essential for making informed decisions when choosing a trading platform. Whether you are a high-volume trader or a casual investor, Binance's Maker Taker Trading Fees can significantly impact your trading experience.

This article address:https://www.binhlongphanthiet.com/eth/72d70499223.html

Like!(95)

Related Posts

- Binance BTC Perpetual: A Game-Changing Trading Instrument for Cryptocurrency Investors

- Can I Send Bitcoin Through CashApp?

- What is Bitcoin Cash Worth Now: A Comprehensive Analysis

- Bitcoin Price Graph Sterling: A Comprehensive Analysis

- How Do You Get Listed on Binance?

- Fast Bitcoin Mining: The Future of Cryptocurrency

- Can You Buy Bitcoin at an ATM?

- How to Verify a Bitcoin Wallet: A Comprehensive Guide

- Binance App QR Scanner: A Game-Changer for Cryptocurrency Transactions

- The Rising Price of 1 Share of Bitcoin: A Closer Look at the Cryptocurrency Market

Popular

Recent

Best Way to Cash Out Bitcoin: A Comprehensive Guide

Bitcoin Price Prediction for June 2024: What to Expect?

**Withdrawal Processing at Binance: A Comprehensive Guide

Binance High BTC Withdrawal Fee: What You Need to Know

Binance BTC LTC: A Comprehensive Guide to Trading on Binance

Mining Bitcoin Gold with Ethos: A Sustainable Approach to Cryptocurrency Mining

Binance Top Crypto: The Ultimate Guide to the Most Popular Cryptocurrencies on Binance

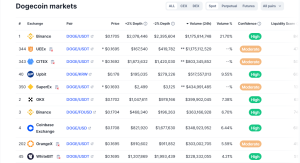

**Dogecoin Binance Price: A Comprehensive Analysis of the Cryptocurrency's Value on the Leading Exchange

links

- How to Deposit Bitcoin into a Wallet: A Step-by-Step Guide

- Adding Binance Smart Chain Network to Metamask: A Comprehensive Guide

- Protect Bitcoin Wallet Identity: A Comprehensive Guide

- Hot Get a Bitcoin Cash: The Ultimate Guide to Acquiring Cryptocurrency

- **Mining Rig Bitcoin for Sale: A Comprehensive Guide to Purchasing and Utilizing Bitcoin Mining Hardware

- Best Bitcoin Wallet for Privacy and Security: A Comprehensive Guide

- **Making a Coin on Binance Chain: A Comprehensive Guide to Cryptocurrency Creation

- **Navigating the World of Cryptocurrency: Top Apps Where You Can Buy Bitcoin

- Binance Crypto Withdrawal Fee: Understanding the Costs and Strategies to Minimize Them

- The Next Coin to Launch on Binance: What You Need to Know