You are here:Chùa Bình Long – Phan Thiết > block

Bitcoin Weekly Forecast: BTC/USD Price May Break Below Monthly Support

Chùa Bình Long – Phan Thiết2024-09-20 21:24:59【block】7people have watched

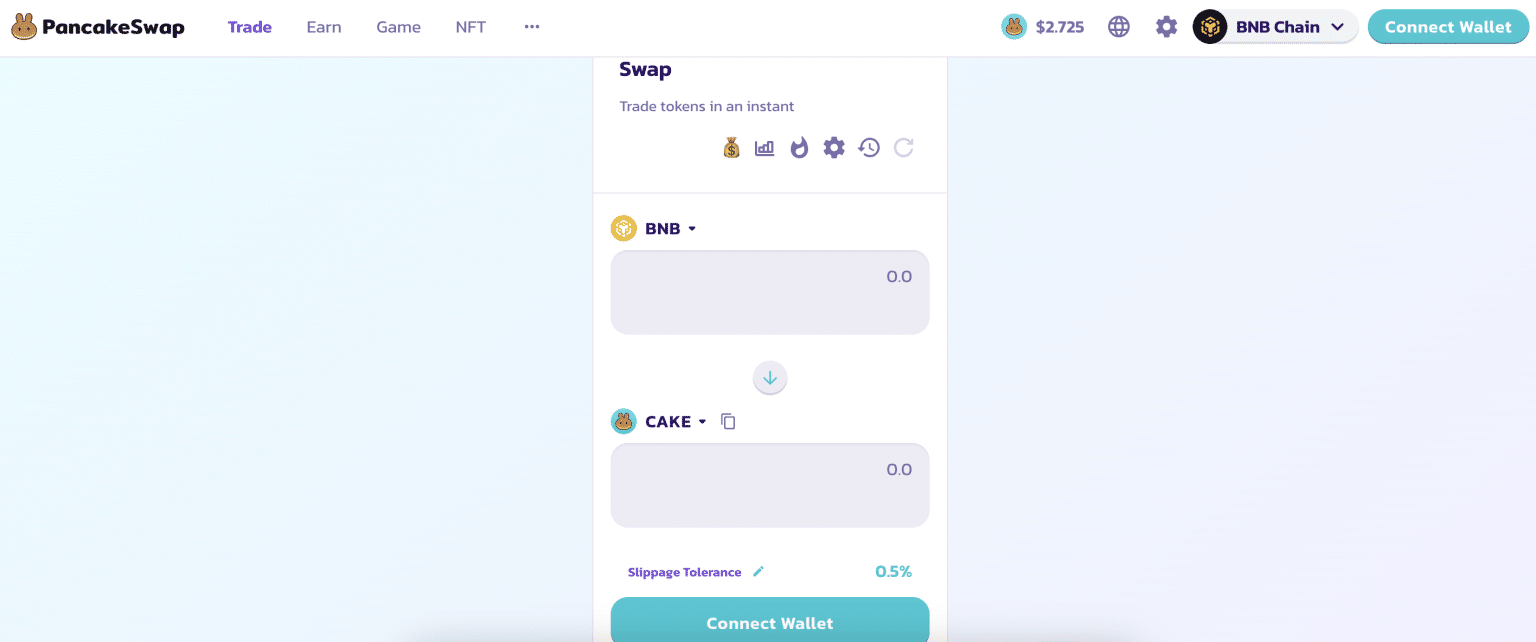

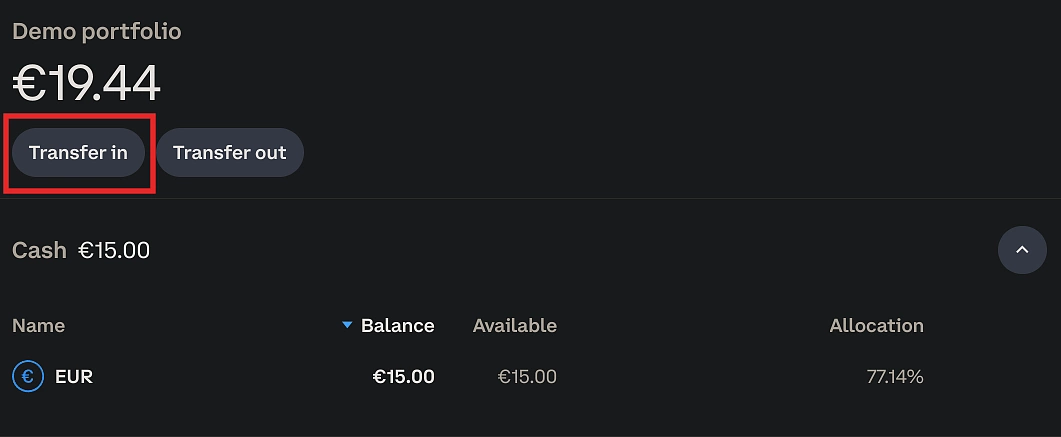

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market has been experiencing a rollercoaster ride lately, with Bitcoin (BTC) bein airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market has been experiencing a rollercoaster ride lately, with Bitcoin (BTC) bein

The cryptocurrency market has been experiencing a rollercoaster ride lately, with Bitcoin (BTC) being at the forefront of this volatility. As we approach the end of the week, many are keeping a close eye on the weekly forecast for BTC/USD, which suggests that the price may break below the monthly support level.

Bitcoin Weekly Forecast: BTC/USD Price May Break Below Monthly Support

The recent rally in the cryptocurrency market has been fueled by various factors, including regulatory news, technological advancements, and increased institutional interest. However, the current Bitcoin Weekly Forecast indicates that the price may face a significant challenge in the coming days.

Bitcoin Weekly Forecast: BTC/USD Price May Break Below Monthly Support

According to the latest analysis, the BTC/USD pair is currently trading around $30,000, having experienced a sharp decline from its all-time high of nearly $69,000 in November 2021. The weekly forecast suggests that the price may continue to fall, potentially breaking below the monthly support level of $28,000.

Bitcoin Weekly Forecast: BTC/USD Price May Break Below Monthly Support

Several factors contribute to this bearish outlook. Firstly, the recent regulatory news from various countries has raised concerns about the future of cryptocurrencies. China's crackdown on mining activities and other countries considering stricter regulations have created uncertainty in the market.

Secondly, the ongoing global economic situation, including rising inflation and central banks' tightening policies, has negatively impacted Bitcoin's correlation with traditional assets. This correlation has historically been a key driver of Bitcoin's price movements, and the current environment may continue to weigh on the cryptocurrency.

Furthermore, the upcoming Bitcoin halving event, scheduled for April 2024, has been a topic of discussion among market participants. While some believe that the halving will lead to a bull run, others argue that the event may not have the same impact as in previous years due to the increasing supply of alternative cryptocurrencies.

Bitcoin Weekly Forecast: BTC/USD Price May Break Below Monthly Support

In addition to these factors, technical analysis suggests that the BTC/USD pair may face resistance at the $30,000 level. If the price fails to hold above this level, it could potentially break below the monthly support level of $28,000, leading to further declines.

Bitcoin Weekly Forecast: BTC/USD Price May Break Below Monthly Support

However, it is important to note that cryptocurrency markets are highly unpredictable, and the weekly forecast is just one of many indicators. There are always risks involved when trading cryptocurrencies, and it is crucial for investors to conduct thorough research and consider their risk tolerance before making any investment decisions.

In conclusion, the Bitcoin Weekly Forecast suggests that the BTC/USD price may break below the monthly support level of $28,000 in the coming days. While this forecast is based on various factors, including regulatory news, economic conditions, and technical analysis, it is essential for investors to remain cautious and stay informed about the latest market developments. As always, the cryptocurrency market is subject to rapid changes, and it is crucial to adapt to these changes accordingly.

This article address:https://www.binhlongphanthiet.com/eth/76d69499229.html

Like!(554)

Related Posts

- Bitcoin Annual Price Chart: A Comprehensive Analysis

- Virtual Mining Game for Real Bitcoin: A New Trend in the Cryptocurrency World

- Should I Buy Bitcoin Cash Quora: A Comprehensive Guide

- How to Send Bitcoin on Cash App: A Step-by-Step Guide

- Next New Coin on Binance: What to Expect and How to Prepare

- The Price of One Bitcoin in 2015: A Look Back at the Cryptocurrency's Evolution

- The SEC's Crackdown on Binance and Coinbase: A New Era for Cryptocurrency Regulation

- WWE Streaming Mining Bitcoin: A New Trend in Entertainment and Cryptocurrency

- Do I Have to Report Bitcoin Wallet Ownership?

- How to Send Bitcoin on Cash App: A Step-by-Step Guide

Popular

- Bitcoin Cash Bull Run: The Resurgence of a Cryptocurrency Giant

- Bitcoin Diamond Wallet Support: Ensuring Secure and Efficient Transactions

- Connect Binance Smart Chain: A Comprehensive Guide to the Future of Blockchain Technology

- Virtual Mining Game for Real Bitcoin: A New Trend in the Cryptocurrency World

Recent

Coins to List on Binance: A Comprehensive Guide to Upcoming Cryptocurrency Listings

Should I Buy Bitcoin Cash Quora: A Comprehensive Guide

Can I Leave My TRX on Binance?

https www.bitsonline.com bitcoin-price-tanks-hard-fork: The Impact of the Recent Hard Fork on Bitcoin's Value

Is Bitcoin Safe on Cash App?

Bitcoin Animation Mining: A Visual Journey into the Cryptocurrency World

Unlock the Power of Real Bitcoin Mining with Referral Code: Real Bitcoin Mining Referral Code

The SEC's Crackdown on Binance and Coinbase: A New Era for Cryptocurrency Regulation

links

- Ways to Make Money Like Bitcoin Mining

- Bitcoin Price History Chart 2019: A Comprehensive Analysis

- Bitcoin Mining KWh: The Energy Consumption Behind Cryptocurrency Mining

- Bitcoin Wallet Trusted Peer: Ensuring Security and Trust in Cryptocurrency Transactions

- Track Wallet Bitcoin: A Comprehensive Guide to Managing Your Cryptocurrency

- Can I Buy Bitcoin as a Gift?

- Bitcoin Mining Motivation: The Driving Force Behind the Cryptocurrency Revolution

- How Is Bitcoin Transferred into Cash?

- The Rise of Bitcoin: How Cash App is Revolutionizing the Cryptocurrency Landscape

- **Exploring the ER20 Token List on Binance: A Comprehensive Guide