You are here:Chùa Bình Long – Phan Thiết > bitcoin

Bitcoin Price with Volume: A Comprehensive Analysis

Chùa Bình Long – Phan Thiết2024-09-20 21:16:49【bitcoin】2people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the world of cryptocurrency, Bitcoin remains the most popular and widely recognized digital asset airdrop,dex,cex,markets,trade value chart,buy,In the world of cryptocurrency, Bitcoin remains the most popular and widely recognized digital asset

In the world of cryptocurrency, Bitcoin remains the most popular and widely recognized digital asset. Its price fluctuations and trading volume have always been the focal points for investors and traders. In this article, we will delve into the relationship between Bitcoin price and volume, providing a comprehensive analysis of this crucial aspect of the cryptocurrency market.

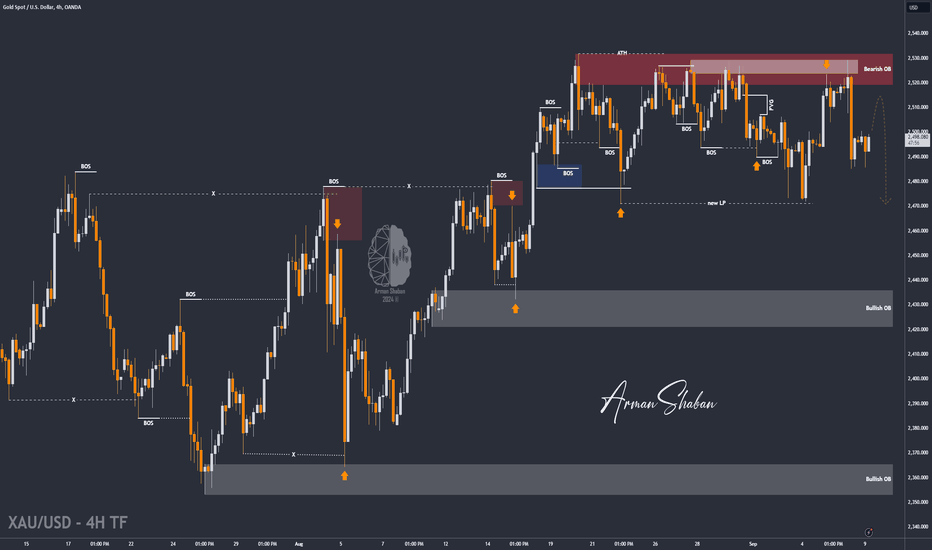

Firstly, let's define what we mean by "Bitcoin price with volume." The price of Bitcoin refers to the current market value of one Bitcoin in terms of a fiat currency, such as the US dollar. Volume, on the other hand, represents the total number of Bitcoin units traded over a specific period. The relationship between Bitcoin price and volume is essential for understanding market trends and making informed investment decisions.

Historically, there has been a strong correlation between Bitcoin price and volume. When the price of Bitcoin increases, the trading volume tends to rise as well. This correlation can be attributed to the fact that higher prices attract more buyers, leading to increased trading activity. Conversely, when the price of Bitcoin decreases, the trading volume often follows suit, as investors and traders may become more cautious or exit the market.

One of the key reasons for the correlation between Bitcoin price and volume is the psychological aspect of the market. When Bitcoin's price is rising, it creates a positive sentiment among investors, leading to increased buying pressure. This, in turn, drives up the trading volume. Similarly, when the price is falling, negative sentiment can lead to selling pressure and a decrease in trading volume.

Another factor that influences the relationship between Bitcoin price and volume is market sentiment. During periods of high market sentiment, such as bull markets, Bitcoin's price tends to rise significantly, and the trading volume follows suit. Conversely, during bear markets, when sentiment is negative, the price of Bitcoin may decline, and the trading volume may also decrease.

However, it is important to note that the relationship between Bitcoin price and volume is not always straightforward. There can be instances where the price of Bitcoin increases without a corresponding increase in trading volume. This may indicate that the price increase is driven by a small group of large investors or whales, rather than widespread market participation. In such cases, the price increase may not be sustainable, and a subsequent correction could occur.

Moreover, the relationship between Bitcoin price and volume can also be influenced by external factors, such as regulatory news, technological advancements, or macroeconomic events. For example, a positive regulatory announcement or a significant technological breakthrough can lead to an increase in Bitcoin's price and volume, while a negative event can have the opposite effect.

In conclusion, the relationship between Bitcoin price and volume is a crucial aspect of the cryptocurrency market. Understanding this relationship can help investors and traders make informed decisions. While there is often a correlation between the two, it is important to consider other factors, such as market sentiment and external events, when analyzing Bitcoin's price and volume. By keeping a close eye on this relationship, one can better navigate the volatile world of cryptocurrency trading.

This article address:https://www.binhlongphanthiet.com/eth/88e8699825.html

Like!(8)

Related Posts

- Can Governments Make Bitcoin Illegal?

- i can't get into my binance account: What to Do When You're Locked Out

- How to Deposit Money to Bitcoin Wallet: A Comprehensive Guide

- Ledger Nano Bitcoin Cash: The Ultimate Security Solution for Your Cryptocurrency Holdings

- **The Future of Bitcoin Price in 2044: A Glimpse into the Cryptocurrency Landscape

- Satoshi Mining Bitcoin Cash: A Deep Dive into the World of Cryptocurrency

- What Was the Price of a Bitcoin When It Started?

- Square Blockstream Bitcoin Blockstream Mining: The Future of Cryptocurrency Mining

- The Benefits of Mining Bitcoin

- Ubuntu 16.04 Bitcoin Wallet: A Comprehensive Guide

Popular

Recent

How to Buy Cryptocurrency with USD on Binance: A Step-by-Step Guide

What is Bitcoin Cash Plus?

Better to Buy Bitcoin or Bitcoin Cash?

Why Bitcoin Price is Going Down in India

Jaxx Can't Bitcoin Cash: The Controversy Unveiled

What Calculations Are Done in Bitcoin Mining

Wakanda Coin on Binance: A Game-Changing Cryptocurrency Partnership

Bitcoin Price Prediction: The Future of Cryptocurrency

links

- US Launches Probe into Bitcoin Price Manipulation

- How to Cash Out Bitcoin in Singapore: A Comprehensive Guide

- Will Dogelon Be Listed on Binance?

- Is There a Trading Fee on Binance?

- Can I Buy 5 of Bitcoin? A Comprehensive Guide

- Requirements for Binance Listing: A Comprehensive Guide for Cryptocurrency Projects

- Will Dogelon Be Listed on Binance?

- Binance Withdrawal Turned Off: What You Need to Know

- How to Cash Out Bitcoin in Singapore: A Comprehensive Guide

- Binance Buys Squid: A Strategic Move in the Cryptocurrency Market